U.S., BioWorld MedTech

2023 FDLI Enforcement Conference

FDA facing a ‘somewhat unimaginable’ volume of applications for LDTs

Read More2023 FDLI Enforcement Conference

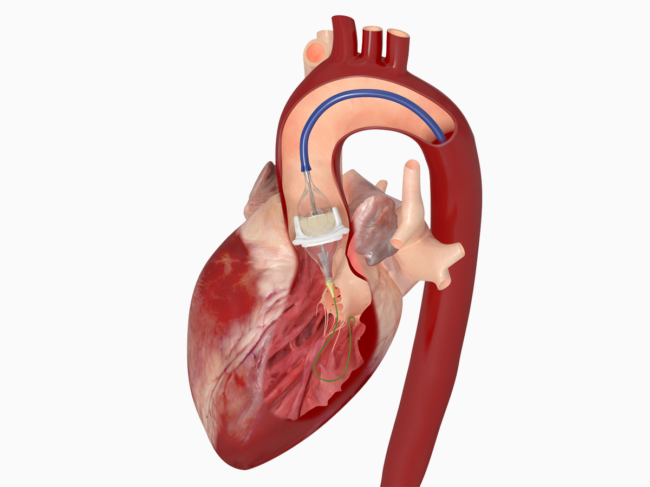

Abiomed warning letter for final deviation seen as opening salvo

Read More2023 FDLI Enforcement Conference